Why We Continue to Avoid China: Persistent Risks Overshadow Opportunity

May 08, 2025For years, the Investment Team has cautioned against the allure of China’s vast market. Recent developments have only reinforced our stance. Despite possessing the world’s second largest economy and population, China remains a minefield for foreign investors, plagued by a lack of transparency, government intervention, unreliable data, and intensifying geopolitical tensions - especially in the shadow of a U.S. - China trade war. In this article, we revisit the key reasons why China continues to fall outside our investable universe, and why we believe the risks of investing in the country outweigh the potential rewards.

China’s lack of transparency - evident by its suppression of critical economic data and indifference to misleading foreign investors - raises serious concerns. Longtime readers may remember a previous Thought Piece in which the Investment Team discussed China’s 2023 decision to stop reporting youth unemployment data following a report that the country’s jobless rate for young adults rose to 21.3% in June of that year. The Chinese Communist Party (CCP) announced that the National Bureau of Statistics of China would not publish the figure until they fixed some issues with its calculation. Their solution? Remove all students from the worker pool.1,2

In another somewhat recent incident, the CCP made the decision to slowly, and then fully, remove strict COVID-19 safety protocols in November and December of 2022. That decision, somewhat predictably, led to a large spike in cases, with scientists estimating that nearly 90% of China’s population became infected in the following months. However, the number of deaths reported from the outbreak (~82,000) were well below what scientists had estimated (~1.5 million).3 During that time, China eliminated their national testing system and twice tweaked their criteria for recording COVID-19 related deaths. Coincidentally, China’s Zhejiang province reported a staggering 171,000 cremations in Q1 of 2023, noticeably higher than 90,000 and 99,000 in Q1 of 2021 and 2022.4 Youth unemployment and COVID-19 related deaths are far from the only examples of China’s tendency to manipulate or conceal essential data when it paints an unfavorable picture.

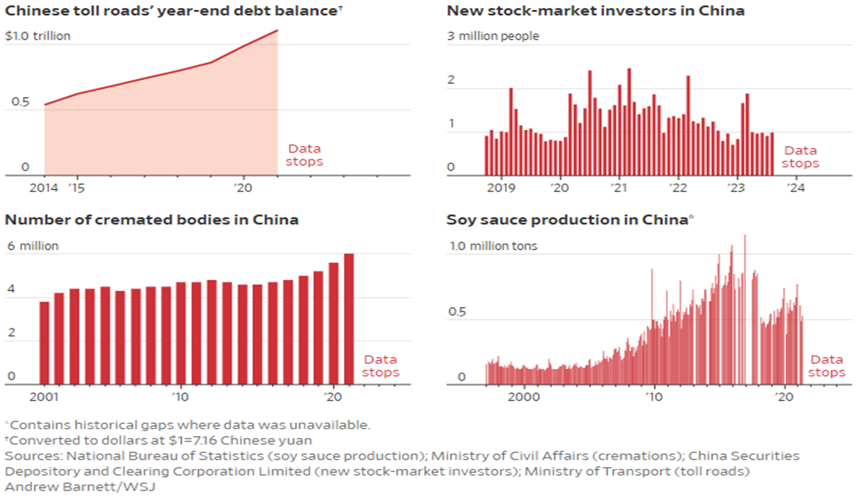

A recent Wall Street Journal article discussed the CCP’s long-rumored exaggeration of GDP growth, and moves to end reporting of land sales, unemployment insurance claims, and tuberculosis vaccinations, among others, as seen below.5

However, many investors have chosen to turn a blind eye to government overreach and censorship thanks to the ‘prosperity’ of the Chinese economy. That prosperity, and the long-discussed threat of surpassing the U.S. as the world’s largest economy and sole super-power, appears to be dissipating. For the past four years, China’s slumping real estate market has held back the economy and bankrupted several of the country’s largest property developers. The crisis, caused by overbuilding and misplaced investment, has led to a 30% decrease in home prices since 2021, and eliminated an estimated $18 trillion in household wealth.6 While there were other factors at play, it is worth noting that the disastrous one child policy (1979-2015) certainly had some effect and will continue to hamper not only the real estate market, but China’s future macroeconomic prospects. For context, China’s birth rate fell below the replacement rate of 2.1 births per woman in 1991, a figure that declined to 1.0 in 2023.7 That demographic trend, combined with the above-mentioned misguided investments in infrastructure and real estate has left provincial governments highly indebted, lost investors trillions, and left skyscrapers and neighborhoods sitting unfinished and empty.8

Considering the governmental overreach, transparency issues, and macroeconomic challenges, we continue to believe investing in China is fraught with risk. This risk is magnified by their increasingly combative relationship with the United States. In recent years, domestic corporations have accused Chinese companies of committing intellectual property theft and have been victims of state-organized cyber espionage campaigns, which have also targeted U.S. infrastructure.9 China appears adamant on gaining control of the self-governing island of Taiwan and has routinely conducted military exercises and built-up artificial islands in the South China Sea as a show of force in disputed territories.

Considering the governmental overreach, transparency issues, and macroeconomic challenges, we continue to believe investing in China is fraught with risk. This risk is magnified by their increasingly combative relationship with the United States. In recent years, domestic corporations have accused Chinese companies of committing intellectual property theft and have been victims of state-organized cyber espionage campaigns, which have also targeted U.S. infrastructure.9 China appears adamant on gaining control of the self-governing island of Taiwan and has routinely conducted military exercises and built-up artificial islands in the South China Sea as a show of force in disputed territories.

Taken together, China’s actions have drawn the attention of U.S. politicians, namely in the form of tariffs and trade restrictions. More understated though is the talk of limiting investments in Chinese companies by U.S. investors. SEC Chairman Paul Atkins expressed a willingness to delist Chinese firms from U.S. exchanges when questioned recently by Tim Scott, Chairman of the Senate Committee on Banking. While a complete ban of all Chinese equities is highly unlikely, it appears that both the U.S. and CCP will continue to make investing in China more difficult.

Even if China and the U.S. manage to broker an end to their trade war, government censorship, continual overreach, and a troubling macroeconomic environment will prevent MAP from investing directly in China. At the end of the day, we are a global value manager. We evaluate each continent and country around the world to determine the viability of investing capital based on economic, political, liquidity, logistical, and regulatory factors. While China may present intriguing opportunities on paper, its systematic risk far outweigh their potential rewards.

We encourage you to contact your MAP representative with any questions or concerns.

Managed Asset Portfolios Investment Team

Michael Dzialo, Karen Culver, Peter Swan, Zachary Fellows, John Dalton, and Nicolas Vilotti

May 8, 2025

1https://www.reuters.com/world/china/chinas-sept-youth-jobless-rate-176-compared-with-188-august-2024-10-22/

2https://www.reuters.com/world/china/china-stop-releasing-youth-jobless-rate-data-aug-says-stats-bureau-2023-08-15/

3https://pmc.ncbi.nlm.nih.gov/articles/PMC10521589/#abstract1

4https://hcn.health/hcn-trends-story/covid-19-leaked-cremation-data-hint-at-true-scale-of-chinas-death-rate/

5https://www.wsj.com/world/china/china-economy-data-missing-096cac9a?mod=hp_lead_pos7

6https://www.bloomberg.com/news/features/2025-02-11/china-s-real-estate-crisis-property-sector-debt-is-getting-worse

7https://data.worldbank.org/indicator/SP.DYN.TFRT.IN?locations=CN

8https://www.bloomberg.com/news/features/2025-02-11/china-s-real-estate-crisis-property-sector-debt-is-getting-worse?embedded-checkout=true

9https://www.wsj.com/tech/cybersecurity/typhoon-china-hackers-military-weapons-97d4ef95

Certain statements may be forward-looking statements and projections which describe our strategies, goals, outlook, expectations, or projections. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. The information contained herein represents our views as of the aforementioned date and does not represent a recommendation by us to buy or sell this security or any other financial instrument associated with it. Managed Asset Portfolios, our clients and our employees may buy, sell, or hold any or all of the securities mentioned. We are not obligated to provide an update if any of the figures or views presented change. Past performance is no guarantee of future results.